目录

- 数据准备

- 阿里巴巴

- 谷歌

- 苹果

- 腾讯

- 亚马逊

- FacONYWKgebook

- 数据可视化

- 查看各个公司的股价平均值

- 查看各公司股价分布情况

- 股价走势对比

- 总结

import numpy as np import pandas as pd from pandas_datareader import data import da编程客栈tetime as dt

数据准备

'''

获取国内股票数据的方式是:“股票代码”+“对应股市”(港股为.hk,A股为.ss)

例如腾讯是港股是:0700.hk

'''

#字典:6家公司的股票

# gafataDict={'谷歌':'GOOG','亚马逊':'AMZN','Facebook':'FB', '苹果':'AAPL','阿里巴巴':'BABA','腾讯':'0700.hk'}

'''

定义函数

函数功能:计算股票涨跌幅=(现在股价-买入价格)/买入价格

输入参数:column是收盘价这一列的数据

返回数据:涨跌幅

'''

def change(column):

# 买入价格

buyPrice=column[0]

# 现在股价

curPrice=column[column.size-1]

priceChange=(curPrice-buyPrice)/buyPrice

# 判断股票是上涨还是下跌

if priceChange>0:

print('股票累计上涨=',round(priceChange*100,2),'%')

elif priceChange==0:

print('股票无变化=',round(priceChange*100,2)*100,'%')

else:

print('股票累计下跌=',round(priceChange*100,2)*100,'%')

# 返回数据

return priceChange

'''

三星电子

每日股票价位信息

Open:开盘价

High:最高加

Low:最低价

Close:收盘价

Volume:成交量

因雅虎连接不到,仅以三星作为获取数据示例

'''

sxDf = data.DataReader('005930', 'naver', start='2021-01-01', end='2022-01-01')

sxDf.head()

| Open | High | Low | Close | Volume | |

|---|---|---|---|---|---|

| Date | |||||

| 2021-01-04 | 81000 | 84400 | 80200 | 83000 | 38655276 |

| 2021-01-05 | 81600 | 83900 | 81600 | 83900 | 35335669 |

| 2021-01-06 | 83300 | 84500 | 82100 | 82200 | 42089013 |

| 2021-01-07 | 82800 | 84200 | 82700 | 82900 | 32644642 |

| 2021-01-08 | 83300 | 90000 | 83000 | 88800 | 59013307 |

sxDf.info()

<class 'pandas.core.frame.DataFrame'> DatetimeIndex: 248 entries, 2021-01-04 to 2021-12-30 Data columns (total 5 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 Open 248 non-null object 1 High 248 non-null object 2 Low 248 non-null object 3 Close 248 non-null object 4 Volume 248 non-null object dtypes: object(5) memory usage: 11.6+ KB

sxDf.iloc[:,0:4]=sxDf.iloc[:,0:4].astype('float')

sxDf.iloc[:,-1]=sxDf.iloc[:,-1].astype('int')

sxDf.info()

<class 'pandas.core.frame.DataFrame'>DatetimeIndex: 248 entries, 2021-01-04 to 2021-12-30Data columns (total 5 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 Open 248 non-null float64 1 High 248 non-null float64 2 Low 248 non-null float64 3 Close 248 non-null float64 4 Volume 248 non-null int32 dtypes: float64(4), int32(1)memory usage: 10.7 KB<class 'pandas.core.frame.DataFrame'> DatetimeIndex: 248 entries, 2021-01-04 to 2021-12-30 Data columns (total 5 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 Open 248 non-null float64 1 High 248 non-null float64 2 Low 248 non-null float64 3 Close 248 non-null float64 4 Volume 248 non-null int32 dtypes: float64(4), int32(1) memory usage: 10.7 KB

阿里巴巴

# 读取数据 AliDf=pd.read_excel(r'C:\Users\EDY\Desktop\吧哩吧啦\学习\Untitled Folder\阿里巴巴2017年股票数据.xlsx',index_col='Date') AliDf.tail()

| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2017-12-22 | 175.839996 | 176.660004 | 175.039993 | 176.289993 | 176.289993 | 12524700 |

| 2017-12-26 | 174.550003 | 175.149994 | 171.729996 | 172.330002 | 172.330002 | 12913800 |

| 2017-12-27 | 172.289993 | 173.869995 | 171.729996 | 172.970001 | 172.970001 | 10152300 |

| 2017-12-28 | 173.039993 | 173.529999 | 171.669998 | 172.300003 | 172.300003 | 9508100 |

| 2017-12-29 | 172.279999 | 173.669998 | 171.199997 | 172.429993 | 172.429993 | 9704600 |

# 查看基本信息及数据类型 AliDf.info()

<class 'pandas.core.frame.DataFrame'> DatetimeIndex: 251 entries, 2017-01-03 to 2017-12-29 Data columns (total 6 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 Open 251 non-null float64 1 High 251 non-null float64 2 Low 251 non-null float64 3 Close 251 non-null float64 4 Adj Close 251 non-null float64 5 Volume 251 non-null int64 dtypes: float64(5), int64(1) memory usage: 13.7 KB

# 计算涨跌幅 AliChange=change(AliDf['Close'])

股票累计上涨= 94.62 %

'''增加一列累计增长百分比''' #一开始的股价 Close1=AliDf['Close'][0] # # .apply(lambda x: format(x, '.2%')) AliDf['sum_pct_change']=AliDf['Close'].apply(lambda x: (x-Close1)/Close1) AliDf['sum_pct_change'].tail()

Date 2017-12-22 0.989729 2017-12-26 0.945034 2017-12-27 0.952257 2017-12-28 0.944695 2017-12-29 0.946162 Name: sum_pct_change, dtype: float64

谷歌

# 读取数据 GoogleDf=pd.read_excel(r'C:\Users\EDY\Desktop\吧哩吧啦\学习\Untitled Folder\谷歌2017年股票数据.xlsx',index_col='Date') GoogleDf.tail()

| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2017-12-22 | 1061.109985 | 1064.199951 | 1059.439941 | 1060.119995 | 1060.119995 | 755100 |

| 2017-12-26 | 1058.069946 | 1060.119995 | 1050.199951 | 1056.739990 | 1056.739990 | 760600 |

| 2017-12-27 | 1057.390015 | 1058.369995 | 1048.050049 | 1049.369995 | 1049.369995 | 1271900 |

| 2017-12-28 | 1051.599976 | 1054.750000 | 1044.770020 | 1048.140015 | 1048.140015 | 837100 |

| 2017-12-29 | 1046.719971 | 1049.699951 | 1044.900024 | 1046.400024 | 1046.400024 | 887500 |

# 计算涨跌幅 GoogleChange=change(GoogleDf['Close'])

股票累计上涨= 33.11 %

'''增加一列累计增长百分比''' #一开始的股价 Close1=GoogleDf['Close'][0] # # .apply(lambda x: format(x, '.2%')) GoogleDf['sum_pct_change']=GoogleDf['Close'].apply(lambda x: (x-Close1)/Close1) GoogleDf['sum_pct_change'].tail()

Date 2017-12-22 0.348513 2017-12-26 0.344213 2017-12-27 0.334839 2017-12-28 0.333274 2017-12-29 0.331061 Name: sum_pct_change, dtype: float64

苹果

# 读取数据 AppleDf=pd.read_excel(r'C:\Users\EDY\Desktop\吧哩吧啦\学习\Untitled Folder\苹果2017年股票数据.xlsx',index_col='Date') AppleDf.tail()

| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2017-12-22 | 174.679993 | 175.419998 | 174.500000 | 175.009995 | 174.299362 | 16349400 |

| 2017-12-26 | 170.800003 | 171.470001 | 169.679993 | 170.570007 | 169.877396 | 33185500 |

| 2017-12-27 | 170.100006 | 170.779999 | 169.710007 | 170.600006 | 169.907272 | 21498200 |

| 2017-12-28 | 171.000000 | 171.850006 | 170.479996 | 171.080002 | 170.385315 | 16480200 |

| 2017-12-29 | 170.520004 | 170.589996 | 169.220001 | 169.229996 | 168.542831 | 25999900 |

# 计算涨跌幅 AppleChange=change(AppleDf['Close'])

股票累计上涨= 45.7 %

'''增加一列累计增长百分比''' #一开始的股价 Close1=AppleDf['Close'][0] # # .apply(lambda x: format(x, '.2%')) AppleDf['sum_pct_change']=AppleDf['Close'].apply(lambda x: (x-Close1)/Close1) AppleDf['sum_pct_change'].tail()

Date 2017-12-22 0.506758 2017-12-26 0.468532 2017-12-27 0.468790 2017-12-28 0.472923 2017-12-29 www.cppcns.com 0.456995 Name: sum_pct_change, dtype: float64

腾讯

# 读取数据 TencentDf=pd.read_excel(r'C:\Users\EDY\Desktop\吧哩吧啦\学习\Untitled Folder\腾讯2017年股票数据.xlsx',index_col='Date') TencentDf.tail()

| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2017-12-22 | 403.799988 | 405.799988 | 400.799988 | 405.799988 | 405.799988 | 16146080 |

| 2017-12-27 | 405.799988 | 407.799988 | 401.000000 | 401.200012 | 401.200012 | 16680601 |

| 2017-12-28 | 404.000000 | 408.200012 | 402.200012 | 408.200012 | 408.200012 | 11662053 |

| 2017-12-29 | 408.000000 | 408.000000 | 403.399994 | 406.000000 | 406.000000 | 16601658 |

| 2018-01-02 | 406.000000 | 406.000000 | 406.000000 | 406.000000 | 406.000000 | 0 |

# 读取数据 TencentDf=pd.read_excel(r'C:\Users\EDY\Desktop\吧哩吧啦\学习\Untitled Folder\腾讯2017年股票数据.xlsx',index_col='Date') TencentDf.tail()

| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2017-12-22 | 403.799988 | 405.799988 | 400.799988 | 405.799988 | 405.799988 | 16146080 |

| 2017-12-27 | 405.799988 | 407.799988 | 401.000000 | 401.200012 | 401.200012 | 16680601 |

| 2017-12-28 | 404.000000 | 408.200012 | 402.200012 | 408.200012 | 408.200012 | 11662053 |

| 2017-12-29 | 408.000000 | 408.000000 | 403.399994 | 406.000000 | 406.000000 | 16601658 |

| 2018-01-02 | 406.000000 | 406.000000 | 406.000000 | 406.000000 | 406.000000 | 0 |

# 计算涨跌幅 TencentChange=change(TencentDf['Close'])

股票累计上涨= 114.36 %

'''增加一列累计增长百分比''' #一开始的股价 Close1=TencentDf['Close'][0] # # .apply(lambda x: format(x, '.2%')) TencentDf['sum_pct_change']=TencentDf['Close'].apply(lambda x: (x-Close1)/Close1) TencentDf['sum_pct_change'].tail()

Date 2017-12-22 1.142555 2017-12-27 1.118268 2017-12-28 1.155227 2017-12-29 1.143611 2018-01-02 1.143611 Name: sum_pct_change, dtype: float64

亚马逊

# 读取数据 AmazonDf=pd.read_excel(r'C:\Users\EDY\Desktop\吧哩吧啦\学习\Untitled Folder\亚马逊2017年股票数据.xlsx',index_col='Date') AmazonDf.tail()

| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2017-12-22 | 1172.079956 | 1174.619995 | 1167.829956 | 1168.359985 | 1168.359985 | 1585100 |

| 2017-12-26 | 1168.359985 | 1178.319946 | 1160.550049 | 1176.760010 | 1176.760010 | 2005200 |

| 2017-12-27 | 1179.910034 | 1187.290039 | 1175.609985 | 1182.260010 | 1182.260010 | 1867200 |

| 2017-12-28 | 1189.000000 | 1190.099976 | 1184.380005 | 1186.099976 | 1186.099976 | 1841700 |

| 2017-12-29 | 1182.349976 | 1184.000000 | 1167.500000 | 1169.469971 | 1169.469971 | 2688400 |

# 计算涨跌幅 AmazonChange=change(AmazonDf['Close'])

股票累计上涨= 55.17 %

'''增加一列累计增长百分比''' #一开始的股价 Close1=AmazonDf['Close'][0] # # .apply(lambda x: format(x, '.2%')) AmazonDf['sum_pct_change']=AmazonDf['Close'].apply(lambda x: (x-Close1)/Close1) AmazonDf['sum_pct_change'].tail()

Date 2017-12-22 0.550228 2017-12-26 0.561373 2017-12-27 www.cppcns.com0.568671 2017-12-28 0.573766 2017-12-29 0.551700 Name: sum_pct_change, dtype: float64

# 读取数据 FacebookDf=pd.read_excel(r'C:\Users\EDY\Desktop\吧哩吧啦\学习\Untitled Folder\Facebook2017年股票数据.xlsx',index_col='Date') FacebookDf.tail()

| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2017-12-22 | 177.139999 | 177.529999 | 176.229996 | 177.199997 | 177.199997 | 8509500 |

| 2017-12-26 | 176.630005 | 177.000000 | 174.669998 | 175.990005 | 175.990005 | 8897300 |

| 2017-12-27 | 176.550003 | 178.440002 | 176.259995 | 177.619995 | 177.619995 | 9496100 |

| 2017-12-28 | 177.949997 | 178.940002 | 177.679993 | 177.919998 | 177.919998 | 12220800 |

| 2017-12-29 | 178.000000 | 178.850006 | 176.460007 | 176.460007 | 176.460007 | 10261500 |

# 计算涨跌幅 FacebookChange=change(FacebookDf['Close'])

股票累计上涨= 51.0 %

'''增加一列每日增长百分比''' # .pct_change()返回变化百分比,第一行因没有可对比的,返回Nan,填充为0 FacebookDf['pct_change']=FacebookDf['Close'].pct_change(1).fillna(0) FacebookDf['pct_change'].head()

Date 2017-01-03 0.000000 2017-01-04 0.015660 2017-01-05 0.016682 2017-01-06 0.022707 2017-01-09 0.012074 Name: pct_change, dtype: float64

'''增加一列累计增长百分比''' #一开始的股价 Close1=FacebookDf['Close'][0] # .apply(lambda x: format(x, '.2%')) FacebookDf['sum_pct_change']=FacebookDf['Close'].apply(lambda x: (x-Close1)/Close1) FacebookDf['sum_pct_change'].tail()

Date 2017-12-22 0.516344 2017-12-26 0.505990 2017-12-27 0.519938 2017-12-28 0.522506 2017-12-29 0.510012 Name: sum_pct_change, dtype: float64

数据可视化

import matplotlib.pyplot as plt

# 查看成交量与股价之间的关系

fig=plt.figure(figsize=(10,5))

AliDf.plot(x='Volume',y='Close',kind='scatter')

plt.xlabel('成交量')

plt.ylabel('股价')

plt.title('成交量与股价之间的关系')

plt.show()

<Figure size 720x360 with 0 Axes>

# 查看各个参数之间的相关性,与股价与成交量之间呈中度相关 AliDf.corr()

| Open | High | Low | Close | Adj Close | Volume | sum_pct_change | |

|---|---|---|---|---|---|---|---|

| Open | 1.000000 | 0.999281 | 0.998798 | 0.998226 | 0.998226 | 0.424686 | 0.998226 |

| High | 0.999281 | 1.000000 | 0.998782 | 0.999077 | 0.999077 | 0.432467 | 0.999077 |

| Low | 0.998798 | 0.998782 | 1.000000 | 0.999249 | 0.999249 | 0.401456 | 0.999249 |

| Close | 0.998226 | 0.999077 | 0.999249 | 1.000000 | 1.000000 | 0.415801 | 1.000000 |

| Adj Close | 0.998226 | 0.999077 | 0.999249 | 1.000000 | 1.000000 | 0.415801 | 1.000000 |

| Volume | 0.424686 | 0.432467 | 0.401456 | 0.415801 | 0.415801 | 1.000000 | 0.415801 |

| sum_pct_change | 0.998226 | 0.999077 | 0.999249 | 1.000000 | 1.000000 | 0.415801 | 1.000000 |

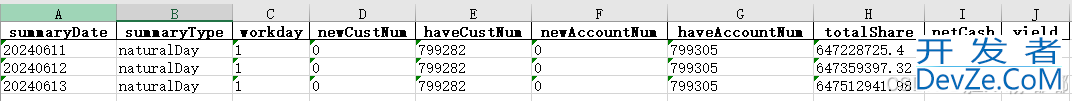

查看各个公司的股价平均值

AliDf['Close'].mean()

141.79179260159364

'''数据准备'''

# 计算每家公司的收盘价平均值

Close_mean={'Alibaba':AliDf['Close'].mean(),

'Google':GoogleDf['Close'].mean(),

'Apple':AppleDf['Close'].mean(),

'Tencent':TencentDf['Close'].mean(),

'Amazon':AmazonDf['Close'].mean(),

'Facebook':FacebookDf['Close'].mean()}

CloseMeanSer=pd.Series(Close_mean)

CloseMeanSer.sort_values(ascendinhttp://www.cppcns.comg=False,inplace=True)

'''绘制柱状图'''

# 创建画板

fig=plt.figure(figsize=(10,5))

# 绘图

CloseMeanSer.plot(kind='bar')

# 设置x、y轴标签及标题

plt.xlabel('公司')

plt.ylabel('股价平均值(美元)')

plt.title('2017年各公司股价平均值')

# 设置y周标签刻度

plt.yticks(np.arange(0,1100,100))

# 显示y轴网格

plt.grid(True,axis='y')

# 显示图像

plt.show()

亚马逊和谷歌的平均股价很高,远远超过其他4家,但是仅看平均值并不能代表什么,下面从分布和走势方面查看

查看各公司股价分布情况

'''数据准备'''

# 将6家公司的收盘价整合到一起

CloseCollectDf=pd.concat([AliDf['Close'],

GoogleDf['Close'],

AppleDf['Close'],

TencentDf['Close'],

AmazonDf['Close'],

FacebookDf['Close']],axis=1)

CloseCollectDf.columns=['Alibaba','Google','Apple','Tencent','Amazon','Facebook']

'''绘制箱型图'''

# 创建画板

fig=plt.figure(figsize=(20,10))

fig.suptitle('2017年各公司股价分布',fontsize=18)

# 子图1

ax1=plt.subplot(121)

CloseCollectDf.plot(ax=ax1,kind='box')

plt.xlabel('公司')

plt.ylabel('股价(美元)')

plt.title('2017年各公司股价分布')

plt.grid(True,axis='y')

# 因谷歌和亚马逊和两外四家的差别较大,分开查看,

# 子图2

ax2=plt.subplot(222)

CloseCollectDf[['Google','Amazon']].plot(ax=ax2,kind='box')

# 设置x、y轴标签及标题

plt.ylabel('股价(美元)')

plt.title('2017年谷歌和亚马逊股价分布')

# 设置y周标签刻度

# plt.yticks(np.arange(0,1300,100))

# 显示y轴网格

plt.grid(True,axis='y')

# 子图3

ax3=plt.subplot(224)

CloseCollectDf[['Alibaba','Apple','Tencent','Facebook']].plot(ax=ax3,kind='box')

# 设置x、y轴标签及标题

plt.xlabel('公司')

plt.ylabel('股价(美元)')

plt.title('2017年阿里、苹果、腾讯、Facebook股价分布')

# 设置y周标签刻度

# plt.yticks(np.arange(0,1300,100))

# 显示y轴网格

plt.grid(True,axis='y')

plt.subplot

# 显示图像

plt.show()

从箱型图看,谷歌和亚马逊的股价分布较广,且中位数偏上,腾讯股价最为集中,波动最小,相对稳定。

股价走势对比

# 创建画板并设置大小,constrained_layout=True设置自动调整子图之间间距

fig=plt.figure(figsize=(15,10),constrained_layout=True)

# ax=plt.subplots(2,1,sharex=True)

fig.suptitle('股价走势对比',fontsize=18)

'''绘制图像1 '''

ax1=plt.subplot(211)

plt.plot(AliDf.index,AliDf['Close'],label='Alibaba')

plt.plot(GoogleDf.index,GoogleDf['Close'],label='Google')

plt.plot(AppleDf.index,AppleDf['Close'],label='Apple')

plt.plot(TencentDf.index,TencentDf['Close'],label='Tencent')

plt.plot(AmazonDf.index,AmazonDf['Close'],label='Amazon')

plt.plot(FacebookDf.index,FacebookDf['Close'],label='Facebook')

# # 设置xy轴标签

plt.xlabel('时间')

plt.ylabel('股价')

# 设置标题

# plt.title('股价走势对比')

# 图例显示位置、大小

plt.legend(loc='upper left',fontsize=12)

# 设置x,y轴间隔,设置旋转角度,以免重叠

plt.xticks(AliDf.index[::10],rotation=45)

plt.yticks(np.arange(0, 1300, step=100))

# 显示网格

plt.grid(True)

'''绘制图像2'''

ax2=plt.subplot(212)

plt.plot(AliDf.index,AliDf['sum_pct_change'],label='Alibaba')

plt.plot(GoogleDf.index,GoogleDf['sum_pct_change'],label='Google')

plt.plot(AppleDf.index,AppleDf['sum_pct_change'],label='Apple')

plt.plot(TencentDf.index,TencentDf['sum_pct_change'],label='Tencent')

plt.plot(AmazonDf.index,AmazonDf['sum_pct_change'],label='Amazon')

plt.plot(FacebookDf.index,FacebookDf['sum_pct_change'],label='Facebook')

# 设置xy轴标签

plt.xlabel('时间')

plt.ylabel('累计增长率')

# 设置标题

# plt.title('股价走势对比')

# 图例显示位置、大小

plt.legend(loc='upper left',fontsize=12)

# 设置x,y轴间隔,设置旋转角度,以免重叠

plt.xticks(AliDf.index[::10],rotation=45)

plt.yticks(np.arange(0, 1.2, step=0.1))

# 显示网格

plt.grid(True)

# 调整子图间距,subplots_adjust(left=None, bottom=None, right=None, top=None,wspace=None, hspace=None)

# 显示图像

plt.show()

可以看出,在2017年间,亚马逊和谷歌的股价虽然偏高,涨幅却不如阿里巴巴和腾讯。

总结

观察以上图形,可以得出一下结果:

1、2017年谷歌和亚马逊股价偏高,波动较大,但其涨幅并不高;

2、2017年阿里巴巴和腾讯的股价平均值相对较小,股价波动比较小,其涨幅却很高,分别达到了94.62%和114.36%。

本篇文章就到这里了,希望能够给你带来帮助,也希望您能够多多关注我们的更多内容!

加载中,请稍侯......

加载中,请稍侯......

精彩评论