I'm trying to get a time series of returns for holding a certain asset for a specific time.

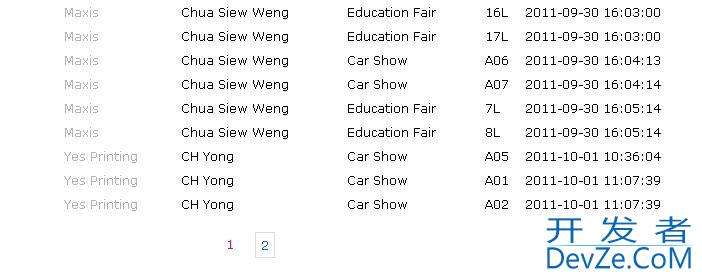

My dataframe looks like this:

Date Price

1998-01-01 20

1998-01-02 22

1998-01-03 21

1998-01-04 25

...

1998-01-20 25

1998-01-21 19

1998-01-21 20

....

1998-02-01 30

1998-02-02 28

1998-02-03 25

1998-02-04 26

etc.

I have 1 observation for each day and my time series goes from 1998-1999.

What I would like to do now is calculate a return for holding my asset for 20 days (i.e. buying it at the first day and selling it at day 20), and do this for each day. So I would like to calculate this:

1.day: Return(20days) = log (Price(t=20) / Price (t=0)),

2.day: Return(20days) = log (Price(t=21) / Price (t=1)),

3.day: Return(20days) = log (Price(t=22) / Price (t=2))

etc., i.e. do this for every day in my sample.

So, my resulting dataframe would look like this:

Date Return

1998-01-01 0.2

1998-01-02 0.4

1998-01-03 0.6

1998-01-04 0.1

...

1998-01-20 0.1

1998-01-21 0.2

1998-01-21 0.5

....

1998-02-01 0.1

1998-02-02 0.2

1998-02-03 0.5

1998-02-04 0.01

etc.

Is there a way 开发者_如何学编程in R to say: take the first 20 observations, calculate the return. Take observation 2-21, calculate the return. Take observation 3-22, calculate the return etc.?

I'm totally stuck and would appreciate some help. Thanks! Dani

I suggest switching to a time series class, like xts or zoo. But if you just want to get it done, and learn more later, you can do it pretty easily as a data frame. Note that I have to pad the return vectors with NAs to make it line up correctly and that a hold of 20 really buy on 1 and sells on 1 + 20:

> library(xts)

> set.seed(2001)

> n <- 50

> hold <- 20

> price <- rep(55, n)

> walk <- rnorm(n)

> for (i in 2:n) price[i] <- price[i-1] + walk[i]

> data <- data.frame(date=as.Date("2001-05-25") + seq(n), price=price)

> data <- transform(data, return=c(diff(log(price), lag=hold), rep(NA, hold)))

If you're ready for xts or zoo (this should work in either), then I suggest using rollapply to get the forward look (assuming you want the forward looking return, which makes it a lot easier to form portfolios today and see how it works into the future):

> data.xts <- xts(data[, -1], data[, 1])

> f <- function(x) log(tail(x, 1)) - log(head(x, 1))

> data.xts$returns.xts <- rollapply(data.xts$price, FUN=f, width=hold+1, align="left", na.pad=T)

The two approaches are the same:

> head(data.xts, hold+2)

price return returns.xts

[1,] 55.00000 0.026746496 0.026746496

[2,] 54.22219 0.029114744 0.029114744

[3,] 53.19811 0.047663206 0.047663206

[4,] 53.50088 0.046470723 0.046470723

[5,] 53.85202 0.041843116 0.041843116

[6,] 54.75061 0.018464467 0.018464467

[7,] 55.52704 -0.001105607 -0.001105607

[8,] 56.15930 -0.024183803 -0.024183803

[9,] 56.61779 -0.010757559 -0.010757559

[10,] 55.51042 0.005494771 0.005494771

[11,] 55.17217 0.044864991 0.044864991

[12,] 56.07005 0.025411005 0.025411005

[13,] 55.47287 0.052408720 0.052408720

[14,] 56.10754 0.034089602 0.034089602

[15,] 56.35584 0.075726190 0.075726190

[16,] 56.40290 0.072824657 0.072824657

[17,] 56.05761 0.070589032 0.070589032

[18,] 55.93916 0.069936575 0.069936575

[19,] 56.50367 0.081570964 0.081570964

[20,] 56.12105 0.116041931 0.116041931

[21,] 56.49091 0.095520517 0.095520517

[22,] 55.82406 0.137245367 0.137245367

Alternatively, if you are using the package xts, then life is made incredibly simple. This is a straight copy-paste of a function I wrote myself a while ago:

ret<-function(x,k=1){

return(diff(log(x),k))

}

You can use the ROC function in the TTR package, or you can just create your own function.

> library(quantmod) # loads TTR

> getSymbols("SPY")

> tail(ROC(Cl(SPY),20))

SPY.Close

2010-12-09 0.01350383

2010-12-10 0.02307920

2010-12-13 0.03563051

2010-12-14 0.03792853

2010-12-15 0.04904805

2010-12-16 0.05432540

> tail(log(Cl(SPY)/lag(Cl(SPY),20)))

SPY.Close

2010-12-09 0.01350383

2010-12-10 0.02307920

2010-12-13 0.03563051

2010-12-14 0.03792853

2010-12-15 0.04904805

2010-12-16 0.05432540

You can just use offset indices by subtracting from a range. (.... but remember that R does not use 0 as a valid index.) Let's say your prices are the second column in a dataframe named prcs2 the first three returns with an interval of 19 days with your data would be :

prcs2[ (20:22)-19, 2] <-c(20,22,21)

prcs2[ (20:22), 2] <-c(25,19,20)

log(prcs2[20:22, 2]/prcs2[ (20:22)-19, 2])

#[1] 0.22314355 -0.14660347 -0.04879016

The following function should do it:

getReturn <- function(data, n=20) {

#Assumes 'data' is a two-column data frame with date in the first column, price in the second

num.rows <- nrow(data)

output.range <- 1:(num.rows-20)

buy.price <- data[output.range,2]

sell.price <- data[output.range+20,2]

returns <- data.frame(log(sell.price) - log(buy.price))

returns <- cbind(data[output.range,],returns)

names(returns) <- c("Date","Price","Return")

return(returns)

}

Sample input and output:

> head(data)

Date Price

1 2001-01-01 20

2 2001-01-02 19

3 2001-01-03 19

4 2001-01-04 18

5 2001-01-05 18

6 2001-01-06 18

> return<-getReturn(data)

> head(return)

Date Price Return

1 2001-01-01 20 0.09531018

2 2001-01-02 19 0.14660347

3 2001-01-03 19 0.14660347

4 2001-01-04 18 0.20067070

5 2001-01-05 18 0.24512246

6 2001-01-06 18 0.20067070

Sample Data

price <- matrix(c(20,22,21,25,25,19,20,30,28,25,26,27,30,32,31,30),ncol= 1);

Calculate 1 day Log Return

OneDayLogReturn <- c(diff(log(price)));

Calculate 10 days Log Return

TenDaysLogReturn <- c(diff(log(price),10))

results:

0.2623643 0.2047944 0.3566749 0.2468601 0.2151114 0.4567584

verify by :

for (i in 1:6) {print(log(price[10+i]/price[i]))}

Similarly, 20 Days return can be calculated using larger sample date and use

c(diff(log(price),20))

or in your case

c(diff(log(price$Return),20))

![Interactive visualization of a graph in python [closed]](https://www.devze.com/res/2023/04-10/09/92d32fe8c0d22fb96bd6f6e8b7d1f457.gif)

加载中,请稍侯......

加载中,请稍侯......

精彩评论