I have an application that will charge users a small fee on a monthly basis, but the amount is VAT-able. VAT is changing in January from 17.5% to 20%.

How does Paypal handle this? I can see in the API that you should pass the Tax Amount https://cms.paypal.com/us/cgi-bin/?cmd=_render-content&content_ID=developer/e_howto_api_nvp_r_CreateRecurringPayments

Does this mean we have to update every recurring payment on behalf of t开发者_如何学运维he customers in Jan?

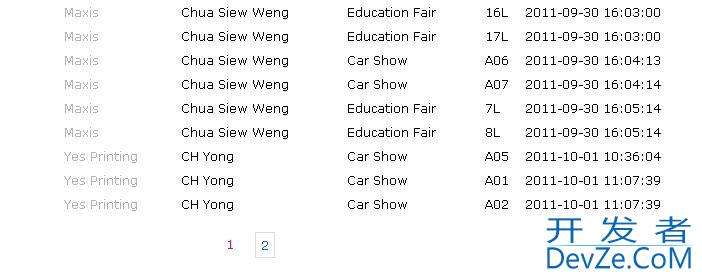

The answer is - you have to amend each payment. Great! A way you could do this, is have a table that stores the VAT values by date.

1st January 2010 - 15%

4th January 2011 - 17.5%

Then on the response from paypal after every recurring payment, calculate the days to the next payment, work out if there is a change in tax using the VAT table, if there is then apply a value change to the recurring payment. (sigh)

![Interactive visualization of a graph in python [closed]](https://www.devze.com/res/2023/04-10/09/92d32fe8c0d22fb96bd6f6e8b7d1f457.gif)

加载中,请稍侯......

加载中,请稍侯......

精彩评论