Portfolio variance is calculated as:

port_var = W'_p * S * W_p

for a portfolio with N assest where

W'_p = transpose of vector of weights of stocks in portfolios

S = sample covariance matrix

W_p = vector of weights o开发者_如何学Cf stocks in portfolios

I have the following numpy matrixes.

Array (vector) of weights of stocks in the portfolio (there are 10 stocks):

weights = np.array(

[[ 0.09],

[ 0.05],

[ 0.15],

[ 0.10],

[ 0.15],

[ 0.15],

[ 0.08],

[ 0.08],

[ 0.1 ],

[ 0.05]])

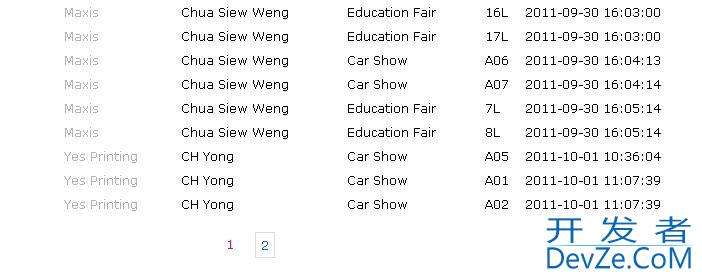

Covariance matrix of stock returns:

covar = np.array([[ 0.00154474 0.00079555 0.00099691 0.00052596 0.0005363 0.00062005

0.00064031 0.00037494 0.00018826 0.00132809],

[ 0.00079555 0.00287429 0.00058536 0.00091774 0.00046885 0.00110434

0.00137141 0.00046724 0.00030414 0.0016615 ],

[ 0.00099691 0.00058536 0.00155757 0.00056336 0.00052395 0.00060104

0.00057223 0.00021365 0.00017057 0.00130247],

[ 0.00052596 0.00091774 0.00056336 0.00126312 0.00031941 0.00088137

0.00024493 0.00025136 0.00011519 0.00135475],

[ 0.0005363 0.00046885 0.00052395 0.00031941 0.00054093 0.00045649

0.00042927 0.00021928 0.00016835 0.00093471],

[ 0.00062005 0.00110434 0.00060104 0.00088137 0.00045649 0.00133081

0.00060353 0.0003967 0.00024983 0.00168281],

[ 0.00064031 0.00137141 0.00057223 0.00024493 0.00042927 0.00060353

0.00468731 0.00059557 0.00020384 0.00078669],

[ 0.00037494 0.00046724 0.00021365 0.00025136 0.00021928 0.0003967

0.00059557 0.00082333 0.00017191 0.00066816],

[ 0.00018826 0.00030414 0.00017057 0.00011519 0.00016835 0.00024983

0.00020384 0.00017191 0.00036348 0.0004505 ],

[ 0.00132809 0.0016615 0.00130247 0.00135475 0.00093471 0.00168281

0.00078669 0.00066816 0.0004505 0.00530036]])

When I compute

weights.T * covar * weights

The result is an array the same size as covar. I am new to portfolio theory but I would imagine that the variance of the portfolio should be a scalar (single value).

Does anyone have experience with this that might help?

np.dot(weights.T,np.dot(covar,weights))

# array([[ 0.00064654]])

For 2D numpy arrays, np.dot is equivalent to matrix multiplication.

For a 2D array np.dotted with a 1D array, np.dot is equivalent to matrix-vector multiplication.

For 1D arrays, np.dot is equivalent to the inner product.

For numpy arrays, the * performs element-wise multiplication (with broadcasting if necessary).

weights.T*np.matrix(covar)*weights

#matrix([[ 0.00064654]])

Alternatively, if you convert covar to a np.matrix, then * is equivalent to matrix multiplication.

![Interactive visualization of a graph in python [closed]](https://www.devze.com/res/2023/04-10/09/92d32fe8c0d22fb96bd6f6e8b7d1f457.gif)

加载中,请稍侯......

加载中,请稍侯......

精彩评论