I would like to calculate the number of periods that have elapsed since the 200 period high of a univariate time series. For example, here's the closing price of SPY:

require(quantmod)

getSymbols("SPY",from='01-01-1900')

Data <- Cl(SPY)

Now, I can find the 200-period highs of this series using the 开发者_JAVA百科Lag function in quantmod:

periodHigh <- function(x,n) {

Lags <- Lag(x,1:n)

High <- x == apply(Lags,1,max)

x[High]

}

periodHigh(Data, 200)

But now I'm stuck. How do I merge this back onto the original series (Data) and calculate, for each point in the series, how many periods have elapsed since the previous n-period high?

This little function returns a list with:

highthe index number of high datesrecentHighthe index number of the most recent high daydaysSincethe number of days since the last highdataan xts object with only the high days. Useful for plotting.

The code:

daysSinceHigh <- function(data, days){

highs <- days-1+which(apply(embed(data, days), 1, which.max)==1)

recentHigh <- max(highs)

daysSince <- nrow(data) - recentHigh

list(

highs=highs,

recentHigh = recentHigh,

daysSince = daysSince,

data=data[highs, ])

}

The results:

daysSinceHigh(Data, 200)$daysSince

[1] 90

plot(Data)

points(daysSinceHigh(Data, 200)$data, col="red")

The answer to your revised question:

require(zoo)

x <- sample(300:500, 1000, replace=TRUE)

str(rollapply(x, 200, function(x) which.max(x)))

# int [1:801] 14 13 12 11 10 9 8 7 6 5 ...

plot(x)

plot(200:1000, rollapply(x, 200, function(x) 200-which.max(x)))

So for the xts series:

plot( rollapply(coredata(Data), 200, function(x) 200-which.max(x)))

I edited the code from the previous answers such that they are functions that take the same inputs (a univariate time series) and return the same output (a vector of days since the last n-day high):

daysSinceHigh1 <- function(x,n) {

as.vector(n-rollapply(x, n, which.max))

}

daysSinceHigh2 <- function(x, n){

apply(embed(x, n), 1, which.max)-1

}

The second function seems to be the fastest, but they're providing slightly different results:

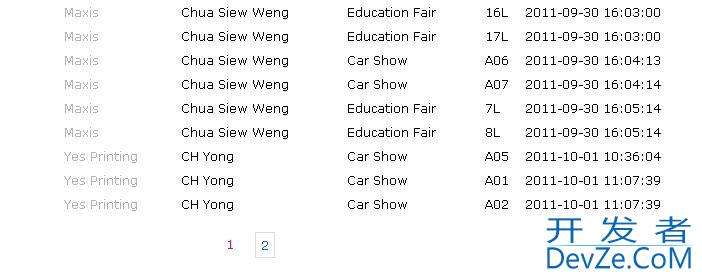

> getSymbols("^GSPC",from='01-01-1900')

[1] "GSPC"

> system.time(x <- daysSinceHigh1(Cl(GSPC), 200))

user system elapsed

0.42 0.00 0.42

> system.time(y <- daysSinceHigh2(Cl(GSPC), 200))

user system elapsed

0.24 0.00 0.24

> all.equal(x,y)

[1] "Mean relative difference: 0.005025126"

Upon closer inspection, it appears that there are some weird edge cases in the 1st function:

data <- c(1,2,3,4,5,6,7,7,6,5,6,7,8,5,4,3,2,1)

answer <- c(0,0,0,0,1,2,3,0,0,1,2,3,4,4)

x <- daysSinceHigh1(data, 5)

y <- daysSinceHigh2(data, 5)

> x

[1] 0 0 0 1 2 3 4 4 0 1 2 3 4 4

> y

[1] 0 0 0 0 1 2 3 0 0 1 2 3 4 4

> answer

[1] 0 0 0 0 1 2 3 0 0 1 2 3 4 4

> all.equal(x,answer)

[1] "Mean relative difference: 0.5714286"

> all.equal(y,answer)

[1] TRUE

Therefore, it seems like the second function (based off Andrie's code) is better.

![Interactive visualization of a graph in python [closed]](https://www.devze.com/res/2023/04-10/09/92d32fe8c0d22fb96bd6f6e8b7d1f457.gif)

加载中,请稍侯......

加载中,请稍侯......

精彩评论