I am learning to use R. I have an interest in pulling stock data and calculating various technical indicators on the stock data. My test ben开发者_运维技巧chmark is Google Finance. That is, I check my results with GF's results.

While trying to implement some sort of MACD analysis, I have noticed a couple of things. These are probably my misinterpretation of the documentation. I have tried many variations and I cannot get agreement with Google Finance's numbers in some cases.

library(quantmod) gives me MACD(), which returns columns macd and signal.

library(fTrading) gives me cdsTA() and cdoTA(), which return cdsTA and cdoTA respectively.

My test stock is IBM, and hopefully this link will pull up a chart with prices, volume, slow stochastics and MACD with histogram.

http://www.google.com//finance?chdnp=1&chdd=1&chds=1&chdv=1&chvs=Linear&chdeh=0&chfdeh=0&chdet=1298224745682&chddm=46920&chddi=86400&chls=CandleStick&q=NYSE:IBM&ntsp=0

Loading up IBM's price data into R and generating the values of the 3 functions above for the values 8, 17, 9 and for MACD() I set percent=FALSE gives me the following output.

MACD(close, 8, 17, 9, maType="EMA", percent=FALSE)

cdsTA(close, lag1 = 8, lag2 = 17, lag3 = 9)

cdoTA(close, lag1 = 8, lag2 = 17, lag3 = 9)

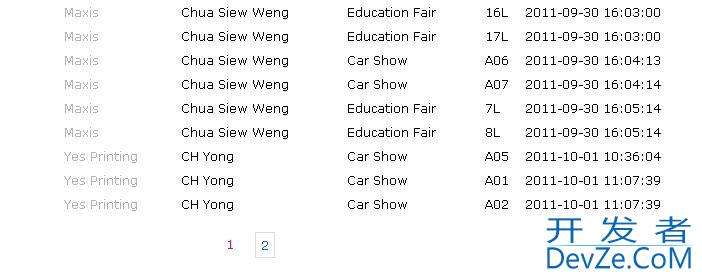

date close macd signal cdsTA cdoTA

2011-02-07 164.17 3.187365 3.208984 3.208984 -0.7673435

2011-02-08 166.05 3.246812 3.216549 3.216549 -0.7996041

2011-02-09 164.65 3.052187 3.183677 3.183677 -1.0496306

2011-02-10 164.09 2.780047 3.102951 3.102951 -1.3332292

2011-02-11 163.85 2.496591 2.981679 2.981679 -1.5867962

2011-02-14 163.22 2.168977 2.819138 2.819138 -1.8408138

2011-02-15 162.84 1.846701 2.624651 2.624651 -2.0507546

2011-02-16 163.40 1.640518 2.427824 2.427824 -2.1262626

2011-02-17 164.24 1.550798 2.252419 2.252419 -2.0854783

2011-02-18 164.84 1.517145 2.105364 2.105364 -1.9968608

If you refer to the google finance chart above, the columns cdsTA and macd are identical and agree closely with Google's EMA figures. MACD()'s value for macd al also pretty close to GF's. And so I get

macd - signal = divergence.

However, cdoTA is way off. What am I doing wrong?

You're not doing anything wrong. The cdoTA code doesn't pass lag1 or lag2 to cdsTA, so it just uses the default values of 12 and 26.

> cdoTA

function (x, lag1 = 12, lag2 = 26, lag3 = 9)

{

cdo = macdTA(x, lag1 = lag1, lag2 = lag2) -

cdsTA(x, lag3 = lag3) # no lag1 or lag2, so...

if (is.timeSeries(x))

colnames(cdo) <- "CDO"

cdo

}

> args(cdsTA) # default arg values are used

function (x, lag1 = 12, lag2 = 26, lag3 = 9)

NULL

You can define your own function CDOTA:

CDOTA <- function (x, lag1 = 12, lag2 = 26, lag3 = 9) {

cdo = macdTA(x, lag1 = lag1, lag2 = lag2) -

cdsTA(x, lag1 = lag1, lag2 = lag2, lag3 = lag3)

if (is.timeSeries(x))

colnames(cdo) <- "CDO"

cdo

}

Or just do the subtraction yourself with the results from TTR::MACD.

require(quantmod)

getSymbols("IBM", source="google")

ibm <- merge(Cl(IBM), MACD(Cl(IBM), 8, 17, 9, "EMA", FALSE))

ibm$macdOsc <- ibm$macd - ibm$signal

tail(ibm)

# IBM.Close macd signal macdOsc

# 2011-02-15 162.84 1.8361263 2.643950 -0.8078238

# 2011-02-16 163.40 1.6248017 2.440120 -0.8153187

# 2011-02-17 164.24 1.5319154 2.258479 -0.7265640

# 2011-02-18 164.84 1.4965394 2.106091 -0.6095520

# 2011-02-22 161.95 1.1140192 1.907677 -0.7936578

# 2011-02-23 160.18 0.6253874 1.651219 -1.0258316

![Interactive visualization of a graph in python [closed]](https://www.devze.com/res/2023/04-10/09/92d32fe8c0d22fb96bd6f6e8b7d1f457.gif)

加载中,请稍侯......

加载中,请稍侯......

精彩评论